The German bank fee case study

Problem

In April 2021 the Supreme Court of Germany ruled against Postbank in a case of increased bank fees - charging a higher bank fee without client consent was declared illegal.

This landmark decision opened an opportunity for the consumers to claim overpaid fees back. Approximately 28+ million consumers are affected with a total of 3+ billion euros of potential claims against German banks.

The average consumer claim against a bank is €150, but depending on the account type the claim can also reach up to €300.

The Supreme Court ruling has the potential to expand to all other business relations that have used silence as customer consent (e.g. telecom, insurance, and other companies).

Solution

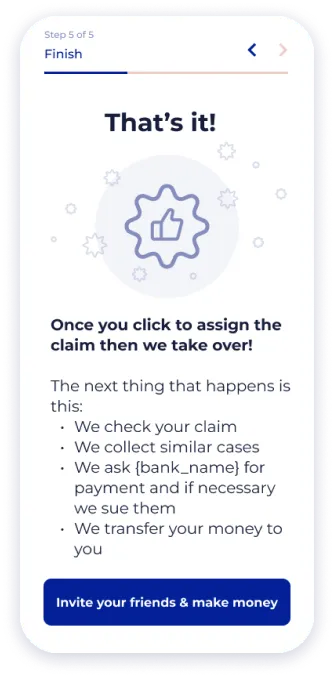

German bank customers who have been the victim of unlawful bank account fees can assign their claims online and in less than 3 minutes and get up to 300 euros of reimbursement without no cost risk.

Role distribution:

HUGO collects claims using an online platform. Claims are validated using specially developed algorithms and enforced in court through highly automated processes.

Vetted claims are assigned to a Special Purpose Vehicle (SPV) licensed under the German Rechtsdienstleistungsgeset.

Grouped claims are taken to court by the legal partner.

Litigation funder funds the costs until proceeds are gained. No cost risk for the claimant.

“HUGO brings marketing and technological expertise to efficiently manage class actions.”